While many can’t keep their credit cards at a zero balance, some people can. I’m one of those people who pay their monthly credit card balance in full (but not after experiencing getting neck-deep in credit card debt first which was one of the reasons why I got to appear on a local business and finance TV show last year!). More than learning my lesson the hard way, I think what made me get my acts together was getting drained (financially and emotionally) by this vicious cycle which only I could break. The thought of being credit card debt-free (and the joy that comes with it!) was just a bonus.

Maintaining a zero balance on credit cards is doable. Here are some practices I employ to make sure the hubby and I get to pay our credit card debts in full every month:

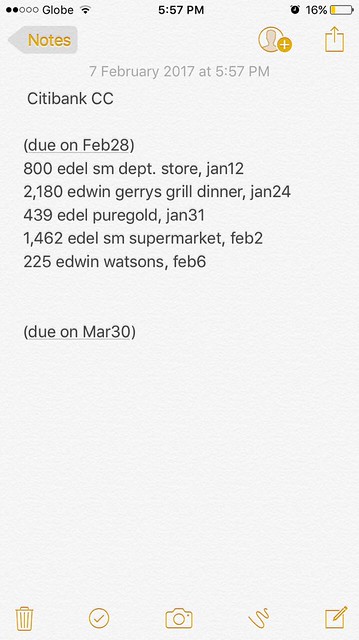

1. Keeping track of our credit card spending. I have this note in my phone that’s dedicated to my purchases using my credit card and other finance-related things. This way, I’d know when a purchase gets included in the current billing cycle or the next. I normally schedule our purchases a day or two after the cut-off date so the payment period is longer. As for the hubby’s credit card, I take care of tracking his purchases and paying for it, too (using his money, of course).

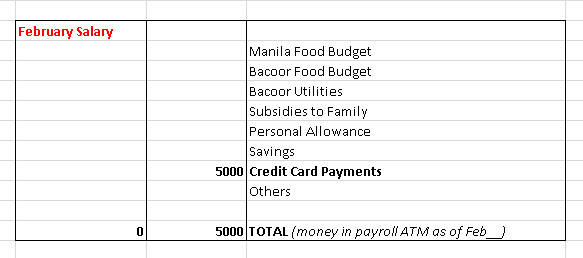

2. Paying for our credit card purchases on the spot. You might ask, how is this possible? It’s like this. Whenever I buy something using my credit card, I make sure I have money to pay for it. I immediately put the money in this “money purse” (where I put all money allotted for credit card payments and other stuff) I keep someplace safe. For example, I went to the supermarket and bought groceries using my credit card. Once I get home, I pay for it using cash from my own wallet and put the money in that “money purse.” If my cash isn’t enough, I record this expense in my phone (the same note I was talking about in no. 1) and allot money from my payroll ATM to pay for it by reflecting it in the MS Excel file I maintain for my finances. )I devised this file back in 2007 and I’ve been using it ever since to balance the money in my payroll ATM.)

Here’s a simplified version of that file so you’ll have an idea:

3. Doing nos. 1 and 2 consistently. Consistency is definitely the key here. You master something through constant practice. You form a habit by doing things repeatedly until it becomes second nature to you. By making sure I keep track of our credit card spending and pay for our credit card purchases on the spot, the hubby and I get to maintain a zero balance on our credit cards. We still avail of items via installment (those under the “real” 0% interest promo only) but we see to it we apply the same approach to them.

One great advantage of having a zero balance on your credit card is you get to have your annual membership fee waived by the bank/credit card company without a fuss. I normally make a request for this to the customer service representative via phone in a nice way and my request gets granted all the time. Annual fees these days range from PHP1,500 to 4,500 depending on the type of your card and its credit limit. Medyo mabigat din sa bulsa, diba? Marami na kaya akong mabibili sa ganung halaga!

4. Praying for a steady supply of discipline and emotional strength to fight shopping temptations. Shopping temptations abound and it takes a great deal of discipline and emotional strength to overcome them. We are just humans, after all. We get tempted with shopping sales, discounts, promos, and all sorts of marketing gimmicks trying to rob us of our hard-earned money all the time. Idagdag mo pa dyan ang social media na para bang pinaparamdam sayo na dapat may ganito ka, may ganyan ka at andito ka, andyan ka. You get the drift. I believe it’s something that needs divine intervention for better management lest you get crazy and accumulate unwanted debts for trying to keep up with the Joneses. I’ve been there and known the feeling. But now that I’m out of that vicious cycle, I can sleep peacefully at night knowing that I’m totally in control of my credit card use.

If you have more tips to share so we could all keep our credit cards at a zero balance, please comment away so we could learn from each other. Thanks in advance! 🙂

May you choose happiness always,

Hay! It’s really difficult to maintain a zero balance on CC. Kaya ako, after I pay off my credit card debt next month, I will have it cut na. Ayoko na talaga. Parati akong natutukso. Haha

Haha, totoo yan! I know some people na mas okay sa kanila na walang credit card para wala daw tukso. 🙂

Ang sarap lang ng feeling pag laging zero balance ang credit card! Salamat sa tips, Edel 🙂 Right now I just use my CC for booking plane tickets, and use cash or debit card for other expenses. I’m trying to break the habit of swiping, sana kayanin hehe!

Thank you, Jackie! Kaya mo yan, hehe. 🙂

Magaling talaga ang banks in tempting you to spend. My one and only CC has a limit of 480k kasi they kept increasing it every year since 2008 (na renew na sya)to try to make me spend more. Same as the others, I only use it for online transactions and make sure I pay it off every month. So far, lamang ako kasi i also earn miles and reward points and never give the bank any interest payments since 2013.

Dont fall into the trap of revolving balances. Ang hirap maka alis dyan and sayang ang binabayad sa banko.

True! At ang bilis nila mag-increase ng credit limit maski hindi ka nagrerequest. Thanks for reminding me. Yan talaga iniiwasan ko, ang magkaroon ng revolving balances. 🙂

Haaaaayyy.. Yun nalang talaga. yun nalang nasabi ko!

Great tips! I also do all and a modified #2.

The only cash in my wallet these days is for my daily allowance. The few bills I have are paid online so no need to withdraw money for those. I usually charge all purchases to my credit card but after each purchase, I transfer said amount to a line item in my budget file for cc payments. This is my version of “paying in cash”. If alam kong walang readily available pambayad, forget the expense if it’s not important. More often than not, it’s just a want hahaha!

Cheers to zero balance credit cards for peace of mind hehehe.

I see you are on iOS. You might want to check out money tracking apps. My favorite is Easy Cost because it allows me to make multiple books: I have one for daily expenses, and another other for savings. Spendee and MoneyLover are also good and have fancier tools for spending analysis, i.e. tracking spending per day, or per category. But it takes some learning. They are all free on the App Store! 🙂 No point spending on money tracking apps, when the point of tracking one’s spending is to save money. 😉

“No point spending on money tracking apps, when the point of tracking one’s spending is to save money. ”

True! Thanks for the reco, Aggie! 🙂

1. Keeping track of our credit card spending. Check.

2. Paying for our credit card purchases on the spot. Check.

3. Doing nos. 1 and 2 consistently. Check.

That’s triple check for me!

For point no. 1: I made a spreadsheet to track our credit card spending. I log every transaction there. Once we receive our credit card billing, I compare it with the spreadsheet. That way, I have a peace of mind that our credit card wasn’t used to make fraudulent transaction/s.

For point no. 2: We, too, only use our credit card when we have money to pay for that certain expense. This made it possible for us to maintain a zero balance on our credit card. As a result, our annual fee has been waived for almost the entire lifetime of our credit card (that’s nearly a decade!).

For point no. 3: I couldn’t agree more.

Zero balance on credit cards for the win!

Right. Spend only what you can pay for. Thanks, S! 🙂