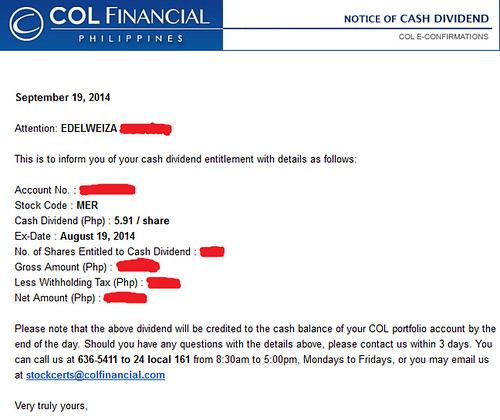

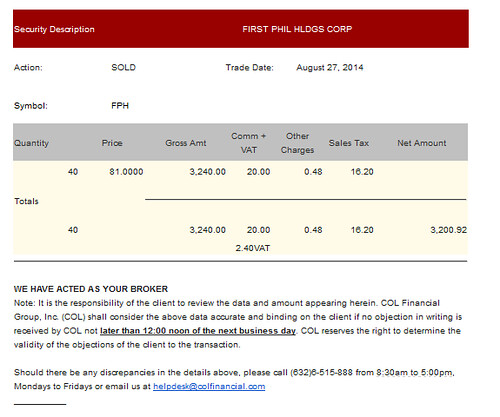

On January 28, 2019, my total locked-in profits in the stock market has reached the 6-digit mark. The exact amount, for my own documentation, is PhP100,327.77. Please note that I have been a direct investor since July 2014 and my total stock market investment is under 500K. I have also been recording my gains consistently from the moment I made my first selling transaction in August 2014 and received my first dividend payout, also in the same period. I’m so happy!

Let me tell you, though, that a portion from these gains is on the losing side at present. But hey, those aren’t considered losses until I sell them (which I won’t do!). I’m just glad the market is starting to get strong again, or at least a lot of my positions are.

Continue reading “Stock Market Journey: My First 6-Digit Gains”