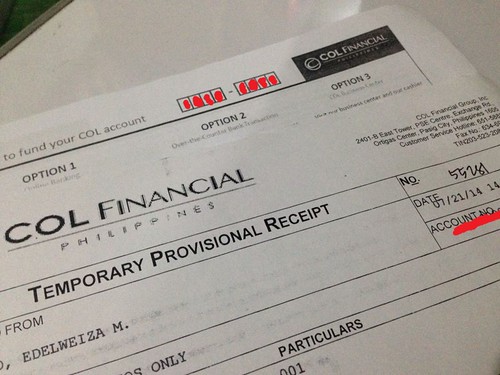

One year after my last post in this series, I’m writing again to celebrate another milestone in my financial life — my third anniversary as a direct stock market investor via COL Financial!

So far, things have been doing great. The market is bullish once again after several months of being bearish. During those gloomy months, I intentionally didn’t check on my port. The few times I did, I just bought more stocks so I could average down those that were in the red at the time, SSI included. And what do you know? SSI finally recovered last month. It went as high as PHP4.33 per share against my average price of PHP3.88. Thinking that the trend would die down soon, I sold my SSI shares immediately when it got to 4.07, which gave me a gain of around 4.8%. Now, why did I not wait for it go higher? I have to admit I got emotional. It’s been more than a year since I had SSI on the red, with losses reaching as high as 43% at one point. Having seen it turning to green recently was an overwhelming feeling. I just felt I needed to sell it right away for fear that its price would go down again and I would have to wait for a long time before it could recover. At least I still made money from it. The decision also prevented me from selling at a loss when I felt like it.

Continue reading “Lessons on Stock Market Investing, Vol. V”