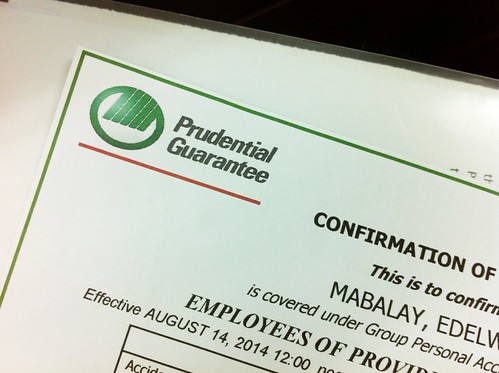

So, the hubby and I finally received our insurance certificate courtesy of the Provident Fund in our office. It’s just a personal accident policy, but we’re still thankful because we got it for free. It’s only good for a year but we heard it’s going to be renewed regularly as one of the perks of our membership.

I already asked them to change my last name to reflect my married name!

I don’t know how much they paid for it, though. As I understood, it’s a group plan and boasts of the following benefits:

Accidental death and disablement, P150,000

Permanent total disability, P150,000

Unprovoked murder or assault, P150,000

Accident medical reimbursement, P15,000

Accident burial benefit, P15,000

It’s just a small coverage but it’s still something, right? The hubby and I hope and pray we won’t have to use it, though. Just knowing we have one is enough for us. Haha.

Having both term insurance and health insurance is part of our long-term plan. (We only depend on PhilHealth at present.) But we haven’t gotten around to getting them yet. I’m still undecided where to get term insurance. I have to research a lot first before buying. As for health insurance, right now I’m 70% sure of availing PhilCare’s ER vantage point prepaid card instead of getting a health policy. You might ask, why a one-time use card instead of the regular heath card? Different strokes for different folks, I guess. (Plus, I was pretty satisfied with PhilCare’s women’s health card I used last September so why not choose PhilCare again?)

How about you, do you also have a life insurance and if yes, from which company is it? 🙂

I never really thought of insurances and the likes until I had a baby! Oh my! Motherhood would really change you. I got Skye insurance and I’m looking for my personal insurance also. Kelangan sure ang future.

Smart mom! I cannot overemphasized the importance of a secure future. Hopefully, makahanap rin kami ni hubby ng life insurance na swak sa budget namin soon. Research-research muna ko. 🙂

My husband and I both got one this year. It was one of our 2014 goals, so yey! I also have a life insurance which my company pays for, pero kasi, kapag nag-resign ako, waley na. That’s why having your own life insurance is a brilliant idea. Ang ginawa pa namin ni hubby, magkaibang life insurance provider ang kinuha namin, just in case malugi ‘yung isa, may backup pa. Haha! :p

Okay yang strategy nyo sis ah, magkaibang provider. Makes me think tuloy if ganun na rin gagawin ko for us. Better protection yun. Haha. 🙂

We also have insurance from the company too but from a different provider. Thankful for it because it pays to have something that can help my family should something happen to me. God forbid though.

Yes, it’s better to have one than nothing. 🙂

Having insurance like that really pays off just in case something happens.

Right, it’s better to be ready always. 🙂

May burial benefit! Something I don’t often encounter. And I agree, this is something we need and I think kung afford ng lahat.. everyone would like to purchase… but not to use. How ironic! Pero for me ang tawag ko dito ay price of having peace of mind din 😉

Yes sis, no using please. Haha. I’m willing to pay for my peace of mind when it comes to things like that. 🙂

Hi Edel, just checking to see if you in deed avail of Philcare ER Vantage Card? How’s this prepaid health card? I’m torn between this and Maxicare Lite and Medicard RxEr. I’m thinking of getting prepaid health card for my pamangkin. TIA.

Hindi pa kami nakakabili, sis… 🙁