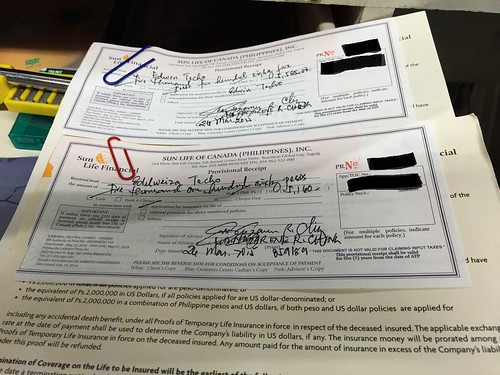

After weighing our options and preparing our payment, the hubby and I have recently gotten ourselves a term insurance from Sun Life Financial. It’s called Sun LifeAssure. As what’s standard, our annual premiums were based on our age. Mine was P5,160 while the hubby’s was a bit higher at P5,585. This is for a coverage of P500,000 with critical illness benefit. For add-ons, we got accidental death and total disability benefits.

Sun LifeAssure is renewed after five years. This means that the annual premiums to be paid for the five-year period (that we signed up for) are fixed. After that, should we decide to sign up again, our premiums will be higher as they will be based on our age again.