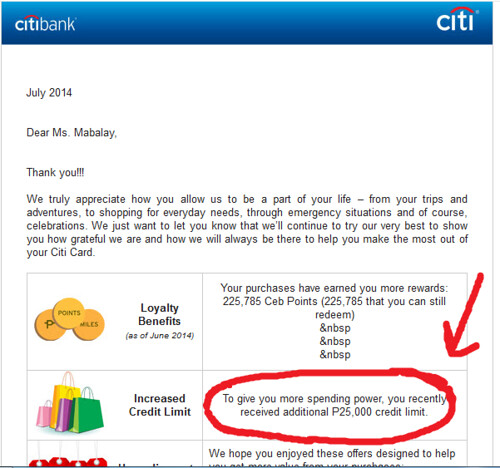

Because I know better now (after learning my lesson the hard way years ago and eventually becoming credit card debt-free), I accumulate rewards from my credit cards instead of debts. I said credit cards (with an “s”) because from having just one credit card, I now have two from the same credit card company — Citibank Cash Back (Visa) and Citibank Rewards (Mastercard). These two different cards come with cool rewards that make using them worth my while. And because I’m now more disciplined than ever, I get to make the most of my credit card rewards!

Continue reading “Making the Most of My Credit Card Rewards”