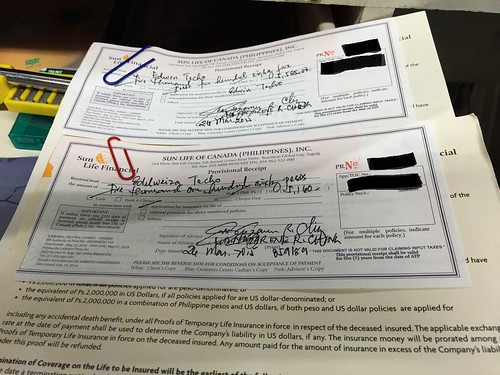

After weighing our options and preparing our payment, the hubby and I have recently gotten ourselves a term insurance from Sun Life Financial. It’s called Sun LifeAssure. As what’s standard, our annual premiums were based on our age. Mine was P5,160 while the hubby’s was a bit higher at P5,585. This is for a coverage of P500,000 with critical illness benefit. For add-ons, we got accidental death and total disability benefits.

Sun LifeAssure is renewed after five years. This means that the annual premiums to be paid for the five-year period (that we signed up for) are fixed. After that, should we decide to sign up again, our premiums will be higher as they will be based on our age again.

Basically, this insurance plan covers 36 critical conditions. If I get diagnosed with any of them, I automatically get the P500,000 full coverage amount for my medical care. If I suddenly die of natural causes, my primary beneficiary gets the same amount. If I die from an accident, the amount my primary beneficiary can claim doubles to P1,000,000. If I get totally disabled due to an accident, my premiums for the five-year period will be paid by the insurance company on my behalf. Whichever comes first.

We opted for a low coverage since we have no dependents yet. We believe this is the best option for us right now. We’ll just change it as the need presents itself. What’s important is that, from now on, we can sleep more peacefully knowing that we are covered if in case something bad happens to us.

This is a great investment and preparation for the future. I, too, have my life insurance through work.

True! Because we never know when we’re gonna need it. Better be safe than sorry. 🙂

Hi,

How did you know your advisor?

im looking for an advisor too, someone who is knowledgeable and would totally understand my insurance need.

Would you please refer?

thanks,

Hi Arlene, she’s my husband’s officemate. She’s just new at Sun Life, in fact, we are her first clients. But she’s hard-working and knowledgeable and we believe in the product so we got from her. 🙂

Hi Edel,

If you dont mind, could you patch me through your advisor (same email address used here)? Im interested to get kasi eh i have few questions.

appreciate it so much.

thanks

Hi Arlene, my advisor is Ivy Cuevillas and I believe, magkausap na kayo? Nirefer kasi kita sa kanya before eh.

Nice! Mark and I also got ours from Sun Life a couple of years back. It’s a great investment indeed! 🙂

kriskamarie.com

Korek ka dyan, sis! 🙂

Inaabangan ko talaga tong post mo rgdg this insurance.

Ask ko lang kung yung Php 5160/5585 – annual, semi annual, quarterly or monthly?

Gusto ko rin sana i- suggest to sa kapatid ko e.

Good for a year (annual) na yan, Grace. 🙂

Hmmm, mura nga sya – parang 430/month lang.

Thanks a lot ms edel 🙂

I have Sun Maxilink Prime. More on retirement naman. I got it when I was single so I was thinking to add another one for my twins naman pero hindi pa keri sa ngayon.

I see. That’s a VUL, right? We got term instead of whole life kasi namamahalan ako. Invest ko na lang yung ibang pera. Pero okay din yan sis pag natapos mo na bayaran wala ka na iintindhin. 🙂

Yup medyo mahal nga sya. Dumating pa nga ko sa time na hindi ko sya nabayaran ng 3 buwan and malapit na palang maclose but I was able to get it back kasi nanghihinayang ako sa lahat ng naihulog ko wala akong makukuha lalo na sa first 2 yrs. Saka importante sya para sa kin dahil may mga anak na ko.

Korek, sis. Tuloy mo na yun dahil naumpisahan na, sayang ang mga binayad mo. 🙂

I’m also in Sunlife. I got the insurance and investment bundled up something. I got Skye too. Wala eh. Kelangan talaga para hindi kawawa ang bata just in case.

Korek ka dyan, sis! I-secure na ang future ni FabSkye! 🙂

Edel, did you have to take medical exam for this type of insurance? Thanks

Nope, it’s not a requirement. 🙂