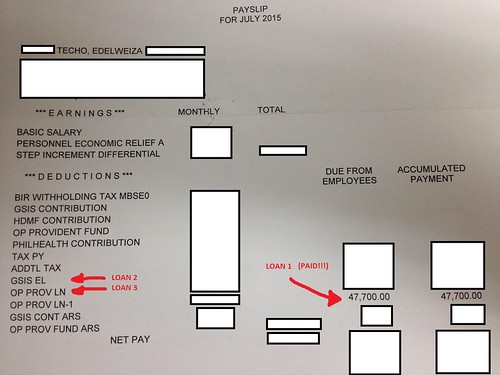

Today is a happy day. It’s pay day and I expect to see a slight increase in my weekly salary because my last month’s pay slip says I’ve already finished paying one of my three cash loans at work. (It’s through salary deduction so I just have to look at my pay slip to check on their status.) The remaining two cash loans will be fully settled by September so that when October arrives (which is actually my birth month!), I could expect more money to finance my birthday party. Haha.

Now, why am I writing about this? Because I waited for this day to come. That one by one, the hubby’s and my loans will be fully paid and we could have more funds to add to our emergency and retirement funds. Our financial goals are as clear as water and our determination remains strong. We just have to stick to our plan and we’re good.

Applying for a cash loan is one thing, paying off a cash loan is another. It’s easy to apply for a cash loan but it’s hard to pay it off. As for me, I only get a cash loan when I know my salary can handle it. I know my survival depends on my salary, it being my primary source of income. I normally plan my strategy before taking out a cash loan. I always make sure that I avail of the shortest payment term to keep the interest low.

Don’t you just hate it when you are left with no choice but to borrow money? I’ve been on that side of the coin before. Why borrow from the bank or some asset based lending – us – 1stCommercialCredit.com when we could change our money habits and try to live within or even below our means, right? Change takes a lot of effort but if we want something and put our heart, mind, and soul into it, we could achieve it. For most of us, aside from happiness and good health, it’s financial freedom. By taking small but bold steps, we can make it happen! 🙂

Matatapos na din ako this September for my SSS Salary Loan! May madadagdag na din ako sa emergency fund at UITF ko! 🙂

Ayoko na din kumuha ng salary loan if ever kung hindi naman talaga kelangan. Kapag natapos mu na kasi gastusin mararamdaman mu na lang ung regret after. Yung house loan ko na lang talaga ang pinakamahirap bayaran kasi 30 yrs sya and we are on 2 yrs pa lang. 🙁

Ang saya, diba? Korek, wag uutang if di naman kailangan talaga. Naku, medyo matagal-tagal pa yung sa house mo, pero okay lang yan, matatapos at matatapos din yan. 🙂

Yeah, loans are…well sometimes we need it in order to survive, and…paying loans is a must. Someday we can be free from all this loans and stuff. Haha! Tapos party party na! Wooh!

Oh by the way, sorry for the intrusion, I’m new here. Let me look around a bit.

Cheers!

Marcelo

Hi Marcelo, welcome to my blog! Yes, in the future mangyayari yun basta gustuhin natin at paghirapan natin. 🙂

Congrats Edel! I hope I could finish paying my sss loan and pag ibig loan this year too. =)

Thanks, Jen! Oo yan. 🙂

I also have SSSLoan to pay. Medyo matagal pa but atleast maliit lang ang bayad. Halos di mo feel. I am really trying to be smart with my finances. Unti unti. Ang hirap pala talaga lalo na’t nasanay na gastador. Oh well.

Tama yan, sis, unti-unti. Kesa walang ginagawa at patuloy sa pagiging gastador. Hehe. We can all change for the better, financially or otherwise. 🙂