This year is getting to be very good in terms of financial blessings. The first quarter alone saw the hubby and I receiving some unexpected incentives at work. Then, during the second quarter, our mid-year bonus arrived and a few more monetary benefits came after that.

Receiving windfalls (in our case, it’s usually from work and nothing else) is always a pleasure and a reason to give thanks. By giving thanks, I mean saying a short prayer of gratitude to the guy above and sharing the blessing (in whatever form or way we like) with our loved ones.

Dealing with windfalls is easy especially if you know where to put your money on. Personally speaking, I follow this formula:

Windfall – Savings or Investments or Both = Planned Expenses

First, I identify the amount to be allotted for each entity. Then, I set aside the money for savings/investments and keep the cash for planned expenses in my wallet. Once the two have been separated, I think about the items in my “planned expenses.”

For the savings/investments, I make sure that the money goes towards those. It’s a non-negotiable. I should stick to the plan or run the risk of losing the money to unplanned expenses. To prevent this from happening, I deal with the matter as soon as possible.

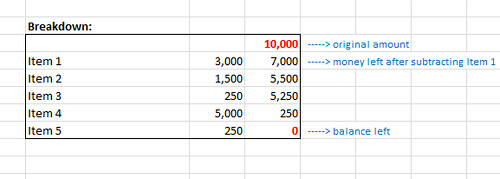

As for the planned expenses, I make a breakdown of the items (e.g. good, service, etc.) I buy. For better monitoring purposes, I make sure my breakdown is simple and straightforward:

That’s it. The system that works for me when it comes to dealing with windfalls.

But here’s the thing. Before I became organized, I used to be careless and directionless with managing my windfalls. Most of them would usually go to debt servicing. Or to pay for advanced purchases. It was a big mistake. But then, it was a good thing I committed that mistake so I could learn from it and change my ways. Now, I know better and so I have better control of my money. It’s kinda fulfilling and liberating, actually.

How about you, how do you deal with windfalls? Let’s learn from each other! 🙂

This is so timely. We had a lot of changes from work. We had an acquisition to a bigger company. So it means we will get our half of 13th month, unused PTO’s and the years that we stayed on the company. If I am single for sure I will spend it to my “luho” nonstop. But when I heard the news I am not excited because I am worried that I might spend it to nonsense things. I really need to plan where will I put it. I was thinking of saving it of course because I don’t have an emergency fund. I wish to open a BPI Direct Savings + Insurance where there is an automated deduction from your account. It is a savings account with insurance and you can’t withdraw it unless online. Hmm what else, I will also add it to my twins’ savings account. And the rest should be put to the bank because at the end of the year we will be getting just half of the 13th month pay. So I need to make sure that I will not spend all the unexpected money that I will be getting.

That’s a good move, sis! Madali maubos ang pera pag hindi planned ang paggastos. Pag nakumpleto mo na ang emergency fund nyo, you can venture in stocks or mutual funds na. Exciting times! 🙂

My dream is to invest in stocks 100% of any upcoming windfalls!!!! wow taray… of course di yan nangyayari palag, but i make sure to transfer agad sa COL account ko at least 50% ng bonus para di ko na magagalaw. Ung the rest, free for all na. hahaha… But i make sure na meron naman kami ni hubby na konting “fun money” yung para sa hobbies namin, konting reward kumbaga. I tried filling out a similar table but somehow, i always forget to update it. 😉

Gusto ko rin yan, sis! Taray, 100% buhos agad doon. Pero tama ka, need din ireward ang sarili from time to time with things that make us happy. 🙂

You always give practical and sound advice on finances! Love reading your posts sis! Thanks for the reminder! =D

Awww, thank you, sis, for appreciating! 🙂

ang haba nung comment ko nawala ata :'(

Nahanap ko na mga comments mo, sis. Thanks for letting me know about that little problem. 🙂

I wish they give bonus here.Unfortunately,it’s not happening.

I think you guys get yours in the form of tax refunds? That’s something naman that we seldom get here. Haha. 🙂

Money management is sooo difficult. I am still mastering the art of it all. I really have to change my lifestyle. Ugh!

Agree, mahirap at need ng discipline. Pero kaya natin yan, sis! 🙂

Hi, I really like your blog. I saw it when I was looking for review on hand mixer then my curiosity kicks me to check on, then I saw this. It’s really helpful specially to us parents. I used and somethings still the happy-go-lucky when it comes to spending windfalls and feeling disappointed after realizing I haven’t save a cent. please post some more. ^.^

Hi Kris, thank you very much for visiting my blog and reading my posts. Like you, I can get sidetracked, too, when it comes to managing my money. It’s a continuous learning, as they say. You may want to check out my “Personal Finance” menu on top for more posts on money and investing. 🙂