I only started saving money more seriously in 2014. It was also around that time when I started investing in the stock market. Back then, I created this MS Excel file that I would update religiously. (I actually use it to this day!) I took advantage of Excel’s autosum feature as a way of adding up the money I got to save every month. I made several tables and filled it with relevant items and figures. I felt happy and accomplished because at the end of each passing year up to December 2016, I saw my savings grew dramatically from how it was prior to 2014.

My monthly income distribution, or how I divide my income to provide for my needs and that of my family, is pretty simple. Take note that this “income” refers only to the salary I receive from my job as a rank-and-file government employee. It doesn’t include the hubby’s as we manage our respective salaries and pay for our marital expenses on a shared basis. He still pays more than I do, like he solely takes care of our house and lot amortization, which is something I appreciate about him.

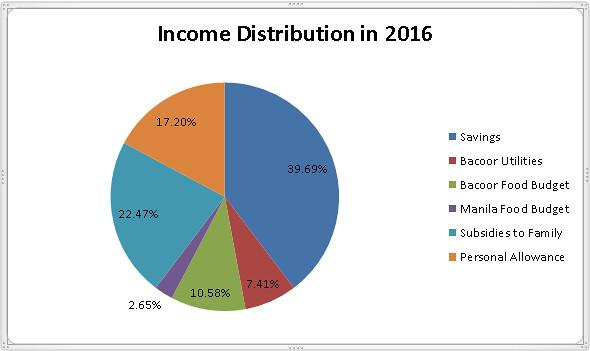

Below is my monthly income distribution in 2016:

Savings – this is allotted to my retirement fund in the form of a savings account (passbook), stocks, UITFs, and RTBs

Bacoor Utilities – this includes power bill, water bill, and cable TV subcription in our Bacoor home

Bacoor Food Budget – our food budget during weekends

Manila Food Budget – my contribution to our food budget at my PILs’ place

Subsidies to Family – this refers to the money I give to the Mabalays which goes to their food budget and almost half of their apartment rent

Personal Allowance – this covers my personal expenses, leisure and travel funds, and other miscellaneous expenses that need to be taken care of immediately

Note: For other expenses like real estate taxes, term insurance, car maintenance, toll fees, home improvement projects, etc., I normally use a portion of my personal allowance, bonuses, and other incentives and share the payments for these items with the hubby.

The beauty of having a clear monthly income distribution is that I can always do offsetting whenever allotting a bigger portion of my salary to more important things is a must. I just make sure the offsetting is limited to those items that don’t have fixed amounts like utilities, food budget, and personal allowance. Fortunately, nothing “major” happened last year that would have forced me to offset my monthly savings rate.

Just like my salary, my savings is also separate from the hubby’s. (But we have a marital or joint emergency fund that we already finished filling up to its ideal amount sometime in 2015.) Last year, to my surprise, my total savings increased by 85.73%. Three things have greatly contributed to this: 1) a salary increase coupled with a few unexpected windfalls, 2) my simple but smart living or how I try to live below my means, and 3) my dogged determination to save more money than I used to. I also made it a point to keep the money allotted to my savings away from my sight and touch either by depositing it in my savings account (with passbook) or adding it to my COL Financial funds to buy more stocks. This way of handling money has been very effective for me, so far. While I cannot disclose my exact figures in Philippine currency on this blog due to security reasons, I know I’m being honest to myself and to anyone who gets to read this post.

I’m happy and proud of this positive development in my financial life. I’m also amazed by how much money people could save if they would be consistent in following their monthly saving targets. But of course, each of us has different income distribution which largely depends on our needs and circumstances at present. As for me, I’m at a better position to save money at this point in my life. I’m also more serious and driven now in growing my savings. And luckily for me, I have a generous husband who pays for my “wants” every now and then. Don’t worry, I return the favor to him as much as I can, hahaha.

It’s so true when they said that it’s not the amount of salary you have, it’s the amount of money you save. A higher salary doesn’t equate to a higher net worth. It’s how you spend and save that determines your financial future. And because time is gold, it follows that we have to start increasing our net worth as early as we could. I started saving money seriously in 2014 when I was 31 years old. I know it’s kinda late already but my income, expenses, and other circumstances as breadwinner back when I was younger didn’t allow me to save as much as I wanted to.

But you know, God always has a way of doing things. Losing hope at any point in our financial life should never be an option. What I’m saying is, there’s always a right time to save. (And I believe it actually requires a combination of discipline, willpower, and faith.) Wag nga lang talaga yung matanda ka na at wala ka ng trabaho saka ka makakaisip na mag-ipon. Kung kaya mong ayusin ang pananalapi mo habang maaga, gawin mo. Pasasalamatan mo pa sarili mo pagdating ng araw!

This 2017, I plan to stick to the same percentages as in my 2016 monthly income distribution. But because we, in government, received the second tranche (out of four) of our salary increase last month, I will increase my monthly savings rate to more than 40% provided that I won’t have additional expenses to pay for. I will also funnel all extra money from my bonuses and other incentives towards my savings so I could grow my wealth faster (i.e. putting the money into various financial instruments such as stocks, UITFs, RTBs), etc.). I will also prepare for unexpected expenses because there is nothing certain in this world. Like if I get pregnant this year, that would definitely affect my income distribution. The hubby and I have been meaning to put up a “baby fund” for this cause and hopefully, we’d be able to start on this soon and be financially-ready when that opportune time comes.

Where did your income go and what was your savings rate last year? I’d love to hear how you managed and continue to manage your finances! 🙂

May you choose happiness always,

Grabe sis. Idol talaga kita pagdating sa financial aspect. Hirap padin ako eh. Pero I honesty believe na nasa mindset talaga. Kelangan ko maging mas kuripot pa.

Naks naman, salamat, sis!!! Mindset at good timing din. Hirap talaga ako makaipon dati, medyo guminhawa lang at tumindi ang disiplina ko a few years ago. 🙂

Wow! 39.69% savings rate! That’s really amazing! I second what Celerhina Aubrey said, idol ka nga 🙂

Haha, salamat, Jill! Medyo seryosohan na ang pag-iipon habang wala pang baby ulit. 🙂

wow! ang laki ng savings! at bago na din template mu! nice!

Hehe. Thank you, sis! 🙂

Hi Edel! Grabe amazing ka! Nasa 40% din ung savings allocation ko pero nakakahanga yung income distribution mo kasi talagang balanse sya for yourself and family members. Idol!!! 🙂

Salamat, Jackie! Sana maging consistent ako. Winiwish ko rin na bumaba yung sa “subsidies to family” kasi ibig sabihin nun mayaman na mga kapatid ko, hehehe. 🙂

Ang taas ng savings rate mo!!! Congratulations!

Nasa between 13-15% sa akin last year for my retirement fund. A big chunk still went to real estate, which at this point is still not income generating. Hopefully though, I can turn these to income generating projects in the years to come. Kailangan ko lang muna tapusin bayaran hahaha!

While I’m happy with my rate last 2016, I hope to do better this year.

Good luck to us all who are trying to really take good care of our financial blessings!

Real estate is also investment so technically, malaki rin ang napunta sa retirement fund mo. Masaya yan lalo pag income generating na ang real estate mo. Yes, Mylene, hope 2017 be as bountiful for all of us! 🙂

OMG this is so useful. I was thinking of the amount of money I earn and I wish I can do the same categorization you do. I’m renting a condo so a bulk of my salary goes there. Now I’m onto reading your how to live frugally article. I think it’s a good start. Hehe

Thanks so much for sharing! This is very helpful!

Ochi | Ochi In The City

You’re welcome, Ochi! Sabi nila, dapat daw 20% lang ng salary ang napupunta sa rent, pero sa taas ng rent ngayon, malamang hindi lang 20% ang ina-allot ng mga tao para dun. Hay, kaya dapat talaga magtipid kundi ubos ang sweldo lagi at walang maiipon. 🙂

Kapag may ganitong post ka, hindi ko alam mararamdaman ko. Hindi ko alam kung babasahin ko pa. Kinakabahan ako. Hahahaha I don’t mean anything negative ha. Ikaw kasi talaga ang expert sa ganitong field. You really walk the talk, and someday sana ako din.

I understand where you’re coming from. Thank you, Diane! In a way, pareho lang tayo, sa food naman ako walang masyadong disiplina, hahaha. 🙂