Some people choose to invest in the bank. Some people choose to invest in real estate. Some people choose to invest in life insurance. Some people choose not to invest in anything. Last Monday, I chose to invest in the stock market. It took me a year before doing so but now that I finally did, I only have high hopes and aspirations.

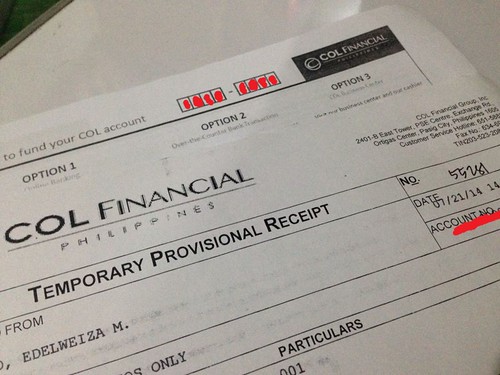

I decided to invest in the stock market directly through COL Financial (www.colfinancial.com), an online broker. This way, I get to have more control over my money and less fees to pay as compared to when I invest in the stock market indirectly through mutual funds. Just to be clear, I have nothing against people who invest in mutual funds. I even think they have an edge because their money is managed by financial experts. I just prefer an online broker over a traditional broker, that’s all. Plus, I like the accessibility and convenience it gives me.