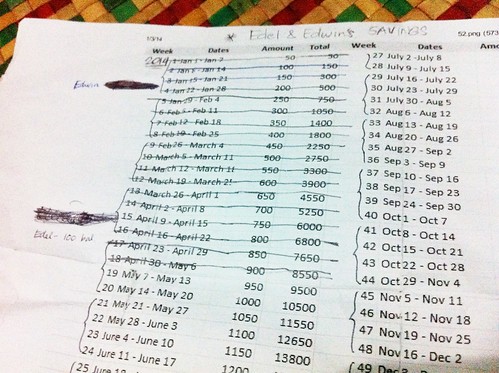

This year is getting to be very good in terms of financial blessings. The first quarter alone saw the hubby and I receiving some unexpected incentives at work. Then, during the second quarter, our mid-year bonus arrived and a few more monetary benefits came after that.

Receiving windfalls (in our case, it’s usually from work and nothing else) is always a pleasure and a reason to give thanks. By giving thanks, I mean saying a short prayer of gratitude to the guy above and sharing the blessing (in whatever form or way we like) with our loved ones.