You’ve heard it before. Living within your means is good. But living below your means is better. I have been living within my means for as long as I can remember. And I found out it’s doable. But living below my means???

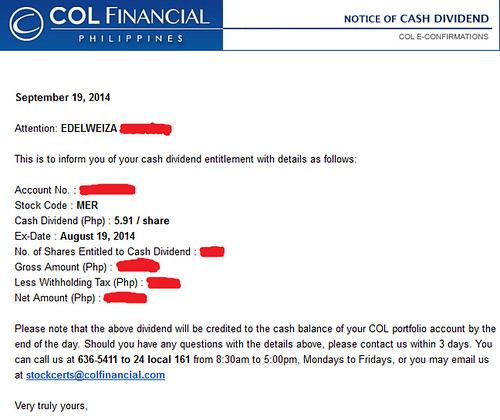

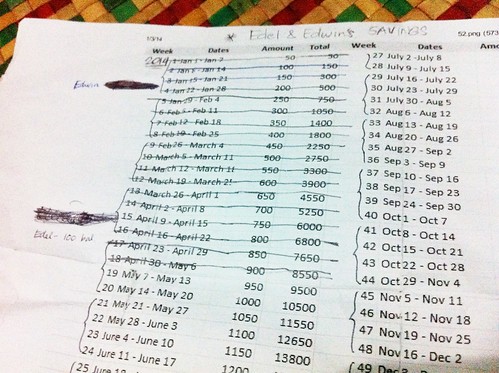

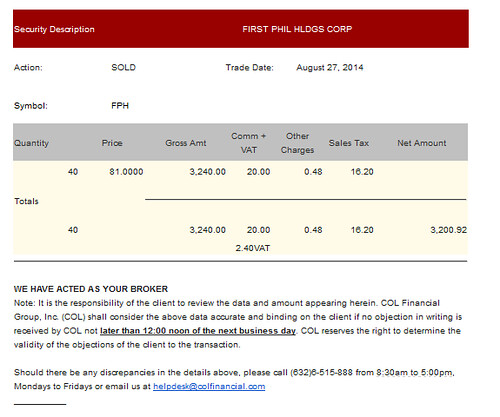

Source: As indicated in the image.

When I started having solid “financial goals” this year, I thought about trying to live below what my income can afford. You see, the hubby and I keep our salaries to ourselves and we just share in our household expenses, mortgage payments, and other bills. (This setup is subject to change any time we I deem it necessary.) The exact percentages I cannot divulge here, but let’s just say he’s a real gentleman.