Today marks my second year of investing directly in the Philippine stock market through COL Financial. So far, everything’s okay. I have a number of paper losses but my profit way exceeds its amount so technically, I’m just losing a part of it, not my capital. Also, as long as I don’t sell the losing stock positions, the paper losses will just be imaginary.

Here are more lessons I feel compelled to share with you as I continue on this exciting financial journey:

On Long-Term and Short-Term Investing

I’ve learned that long-term investing should depend on the nature of the stocks you’re holding. If it’s a stock that has strong fundamentals and is generally a good performer, then by all means invest in it for the long-term. You see, there are stocks that suddenly move up and down in a matter of months and there are those that slowly but steadily go up. It’s smart to trade stocks sometimes especially if these stocks have high volatility, meaning, the price fluctuates dramatically. This is risky, yes, but it’s worth a try. Observe and time the market if you’re goal is to lock-in more gains over a short period of time.

I have done this “trading” thing for a few times and my gains were impressive. Obviously, I have no regrets. I plan to do it whenever necessary and only after a careful analysis, of course. So yeah, I’m a long-term investor, like what I’ve said in the past, but I’ve recently learned to maximize my profit by doing some trading, too.

On Speculative Stocks

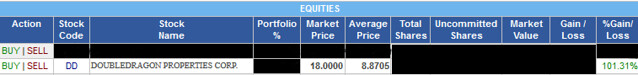

I have three speculative stocks in my portfolio at present. Among them, the most winning one remains to be Double Dragon Properties Corp. (DD). I have experienced doubling my money in it last year and up to 84% growth during the first quarter of this year. Currently, DD remains as robust as ever but its growth has slowed down. I know its price is going to skyrocket sooner or later so I try to keep observing its movement and buying shares whenever I have extra funds.

a part of my port showing DD’s price on September 16, 2015

As for my other speculative stock Store Specialists, Inc. (SSI), the present seems favorable and the future remains bright. I try to buy shares of SSI monthly because I need to average down its price. (I happened to buy SSI at higher prices before, that’s why.) Hopefully, using this cost-averaging method, I could reach a good average price for it.

On Computing Investment Growth

I compute my investment growth at the end of each year. I add up all gains I’ve accumulated from selling stocks and all dividends I’ve received from the companies I invested in and the total becomes my profit. To get the growth percentage, I divide the total profit by the total capital and multiply the result by 100. Do you compute your profit that way also? It’s the simplest I can think of so if you have a better way of doing things, please let me know. Haha.

Lock-in Profits + Dividends = Total Profit

Total Profit/Total Capital x 100 = Total Profit Growth Percentage

Last year, my stock investments grew by 10.74%. That’s good for me already given the not so impressive performance of the stock market all year round. It has even surpassed my target of 8% growth per annum.

On Continuous Investing

Two years into direct stock market investing, I’m still firm in my belief that it’s still best to invest. Investments are risky but just like in life, there are winning and losing moments. I’d like to set my eyes on the former more than the latter. I refuse to entrust all of my money with the bank because I know better than that. And as long as I see good results in what I do with my portfolio, I will continue to do it and improve as an investor.

And you, what have you learned so far in your experience with the Philippine stock market? Share your story, please! 🙂

Check out my previous posts in this series:

Lessons on Stock Market Investing, Vol. III

Lessons on Stock Market Investing, Vol. II

Lessons on Stock Market Investing, Vol. I

May you choose happiness always,

Gang ngaun nasa list ko pa ding tong COL investment. I don’t have the courage yet but I am still planning on creating an account soon soon soon. My UITF with BDO is actually doing great and forgets all about it kasi automated sya. Nagugulat na lang ako sa gains nya. In fairness puro naman sya gains maliit nga lang. So parang feeling ko mas malaki ang gains ko if mag-COL ako though yeah risky nga lang talaga but I am on the long term naman so wala namang kaso dun.

Go, sis! Pag ready ka na, open an account na. 🙂

Lagi kong inaabangan yung update mo about your stock market portfolio. Like Nheng I wish to invest through call kapag nareceive ko yung bonus this year. I want to start kaso wala talaga akong alam sa stocks. As in zero talaga ang knowledge ko. Probably because I am more of a visual learner so kailangan ko din syang makita kung paano. More of these please! 😀

Haha, salamat Jen! Try mo muna mag-open ng account pagdating ng bonus mo, maski yung minimum investment na 5k and just work your way from there. Makikita mo talaga how the stock market works kasi maraming resources na mababasa after mo mag-log in sa COL account mo. 🙂

Just like you, mejo tumataas na rin ang gains ko in my COL account. But I really need to buy more stocks to dilute my shares in First Philippine Holdings since it comprises about 50% of my portfolio AND it’s the only one of my stocks that is still in the red. Kaloka diba?

I’m actually quite scared to know how much gains I’ve made from investing in the stock market. I’m in denial pa since I’d like to believe that I made a significant amount of money after x years of investing. I know I made money but not how much or how many percent of my capital. Yun yung mejo kinakabahan ako:p

Good for us! Malapit na magpang-abot yung market price at average price ng FPH ko, konting-konti na lang, hahaha. Like you, hindi ako nawawalan ng pag-asa dyan kay FPH. It would be very interesting and fulfilling for you to find out about your stock market profit after all these years. Go, Jill! 🙂

Seeing the gains of some of my stocks made me regret why i did not invest more of my money there…. because my mantra is to not put all my eggs in one basket. 😉 But i’m happy that we’re on the green na ulit. Malapit na akong mag- two year anniversary sa investing and so far i’m thankful and happy with my gains.

Thankful and happy din ako, so far. At tama ka, do not put all your eggs in one basket. Kaya kahit tempting magbuhos ng pera sa COL account ko, I only do it during “big money events.” 🙂

I have been wanting to invest in stocks… however, I was advised that unless I have money that is “extra” meaning clean talaga sya after every expenses have been paid, then I shouldn’t.

What can you say about this? Thanks for dropping by my blog btw 🙂

Hello there, thanks for visiting back! Yes, tama yun, dapat ang gagamiting pera sa stock market yung talagang extra money mo na willing kang hindi galawin for a long time kasi nagbabago ang stock prices, pwede ka malugi if iwi-withdraw mo ang investment mo sa panahon na down ang market at naka-red mga stock positions mo. 🙂

The last time I checked, my SSI is still in red. Hindi ko masyado tinitingnan kasi nasasad ako. Hehe. You are right, I should buy SSI stocks regularly to average down the cost. Hindi ko naisip. Hehe.

Buti na lang my BDO and BPI UITFs are doing good.

Tumataas na paunti-unti ang SSI kaya hindi ako nawawalan ng pag-asa. Saka undervalued ang SSI kaya bili pa rin ako ng bili pag may extra money. Yung BDO UITF ko, medyo nakakabawi na rin, kaso lang may nabili kasi ako na mataas ang price dati, yun ang nakikipaglaban pa rin hanggang ngayon. 🙂